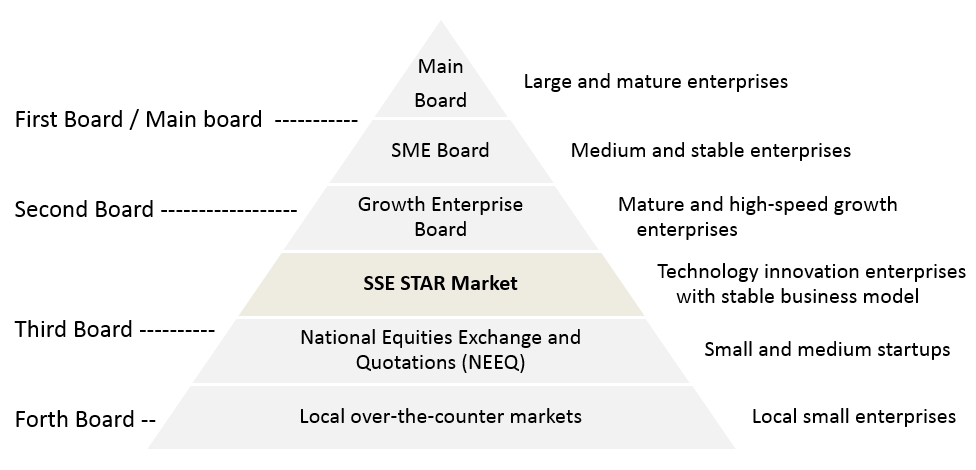

Science and Technology Innovation Board (SSE STAR Market) is a new trading platform in the Shanghai Stock Exchange (SSE) independent from the existing main board, focuses on companies in high-tech and strategically emerging sectors. The pilot registration-based IPO system optimized the issuance conditions, which is a major reform step to simplify the listing process. SSE STAR Market is the central arena of capital serving scientific and technological innovation. The SSE STAR Market plays an important role in guiding innovation resources, capital, and personnel development of innovative enterprises.

The first batch of companies on the SSE STAR Market were listed on 22 July 2019. In the past nine months, total 100 companies have been listed. The total financing amount of these 100 companies listed on the SSE STAR Market (the “STAR companies” for short) reaches RMB118.8 billion. By 28 April 2020, the market capitalization of the 100 STAR companies has exceeded RMB1.3 trillion. The 100 companies listed on the SSE STAR Market are highly concentrated in the high-tech industries and strategic emerging industries, presenting the leading companies of various industry segments. In particular, a number of companies with key technology and outstanding capabilities of technological innovation in the high-end medical equipment, integrated circuits, biomedicine and other industries have been attracted to the SSE STAR Market for listing, and some notable companies with high market recognition and strong capacity for scientific and technological research have joined the market.

The following is the industry distribution of 100 STAR companies as of April 2020:

Source: Shanghai Stock Exchange

Last Updated: April 2020

After-hours fixed-price trading is introduced:

Price limit is appropriately relaxed:

Temporary trading suspension during trading hours:

Volume of a single order is adjusted:

Trading mechanism of securities lending is optimized

The priority will be given to enterprises that are in line with national strategies, master key core technologies, boast outstanding capacity for scientific and technological innovation, rely mainly on core technologies for production and operation, and have a stable business model, high market recognition, a good image in the society and a great potential for growth. The government will focus on supporting new high-tech industries and strategic emerging industries, including new-generation information technology, high-end equipment, new materials, new energy, energy saving and biomedicine to promote the deep integration of the Internet, Big Data, cloud computing and artificial intelligence with manufacturing.

Listing rules

The requirements for institutional investors

The requirements for individual investors

Are investors required to create a new investment account to trade on the SSE STAR Market?

|

SSE STAR Market |

Main Board | |

|---|---|---|

| Market Type |

Floor trading |

Floor Trading |

| Enterprise Type |

Growth-oriented technology innovation Possibly not yet profitable |

Large-scale and mature profitable |

| Listing System | Registration-based | Approval-based |

| Listing Threshold |

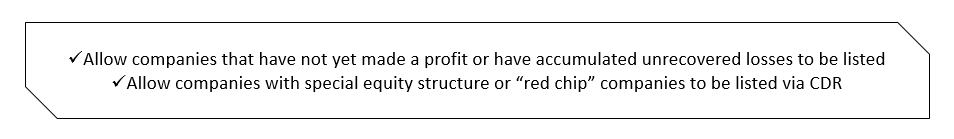

Lower Allow companies with special equity structure or “red chip” companies to be listed via CDR |

Higher |

| Investor Threshold |

Higher Total assets no less than RMB 500,000 per day more than 24 months trading experience |

Lower Meet general conditions |

| Trading Method |

Auction Trading After-hours fixed-price trading Block Trading |

Auction Trading, Block Trading |

| Price Limit |

No limit in the first 5 trading days 20% afterwards |

44% on the first trading day 10% afterwards |